Transformer la FP&A en combinant les insights issus de l’IA et l’Expertise Humaine

Écrit par Michael Coveney, Responsable de la Recherche chez FP&A Trends Group* Introduction Face…

Organizations are increasingly turning to Artificial Intelligence (AI), Machine Learning (ML), and Generative AI (GenAI) in today’s rapidly evolving business landscape to gain a competitive advantage. For FP&A professionals, the convergence of AI with human intelligence is essential to address complex financial challenges and drive strategic decision-making. In this blog, we explore how AI/ML, GenAI, and human ingenuity can complement each other to transform FP&A into a strategic partner.

As covered in a previous blog, AI/ML is set to democratize planning. GenAI – the ability of systems to understand and respond to natural language inquiries – will transform how end-users can take advantage of AI, drastically changing the involvement of FP&A. Traditional tasks such as data management and reporting will give way to new multi-functional roles such as FP&A Data Scientist.

“By 2030, 38.6 million potential FTEs will be displaced by automation. Storytelling with data will be a skill differentiator for the FP&A professional of the future.” ~ Saurabh Jain, CFO Endovascular Robotics, Siemens Healthineers, New York FP&A Board Member.

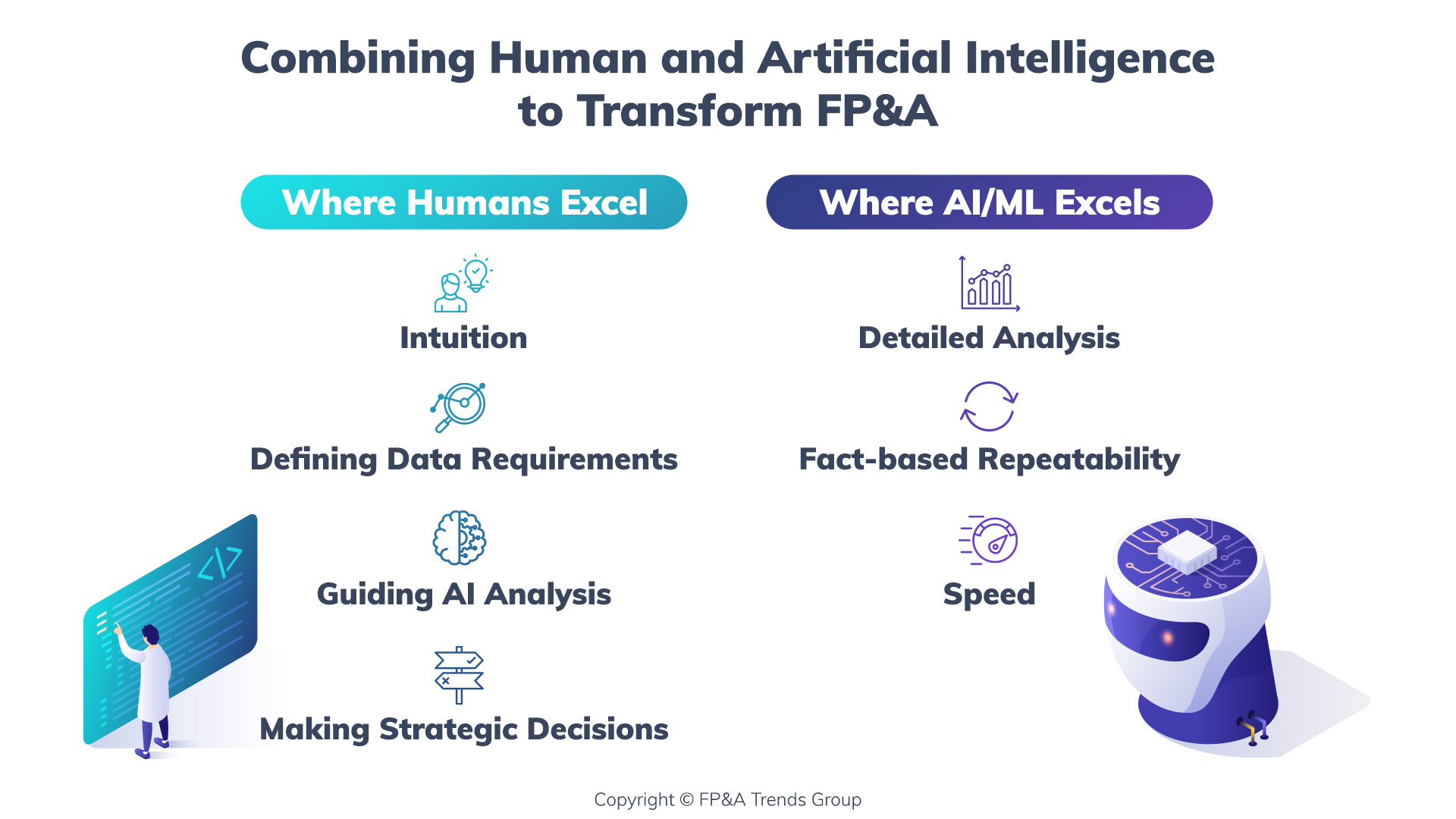

While AI/ML can analyze exponential data volumes to perform daily tasks, human intelligence remains crucial to direct algorithms and interpret the results.

Detailed analysis: AI/ML thrives in analyzing details, where it can deduce patterns and trends, and make predictions at a granular level (e.g. by product line or customer), provided the data is ‘clean’. This means that each dimension of a product, service, or customer can have a unique forecast based on the business environment in which it exists. This is a far more accurate method to produce fact-based predictions that go beyond the capabilities of spreadsheets and older analytical tools.

Repeatability: Like any machine, AI/ML processes are repeatable and not subject to human ‘forgetfulness’ and bias. This eliminates most manual-based errors and subconscious preferences, thereby improving the reliability of results.

Speed: AI/ML works at the speed of light, 24 hours a day. It does not get tired and never takes breaks. The algorithms can analyze huge quantities of data, determine which model produces the best results, and run multiple scenarios in almost real-time. This lowers risk by delivering insights that allow organizations to take advantage of new market developments immediately.

Intuition: Humans are intuitive and great at interpreting non-digital inputs, such as body language and ‘reading between the lines.’ Often, relevant data for an AI/ML algorithm is simply not available. For example, if the government suddenly changes business rules or when a black swan event such as a pandemic occurs. These events could change business performance in a way that is not predictable from historical data.

Defining data requirements: AI requires data, but its algorithms won’t necessarily know what data exists and whether it’s reliable or relevant. A human is needed to decide what data to collect, where to get it, how to ensure its accuracy, and how to count it. AI can help the process, but it needs human guidance and judgment.

Guiding AI analyses: AI/ML has many algorithms, but each can produce different results for the same data sets. As a result, a human is needed to set a starting point in the data sets to include, to know what results make sense, and to identify the purely coincidental results. There are many examples of AI-based predictions and connections that have been spectacularly wrong. The system effectively relies on humans to ensure that the results make sense.

Making strategic decisions: Not all decisions will have measurable results, particularly when an organization’s goal is philanthropic. There may be conflicting priorities between the achievement of short or long-term objectives and resource availability. In these circumstances, a human is needed to make a judgment call to determine which insights take priority.

Fig. 1: Where humans excel versus where AI/ML excels

In a rapidly changing world filled with unpredictable black swan events, historical data may not reliably predict the future. The International FP&A Board advocates for data-informed decisions rather than purely data-driven ones. If FP&A professionals can combine data with intuition, business acumen, and vision, they can deliver more meaningful insights.

As we mentioned earlier, FP&A needs to secure additional skills to benefit from AI. This includes the role of an FP&A Data Scientist who can use and direct AI algorithms, as well as interpret outputs. It is important to remember that AI does not always get things right. Humans are needed to verify that predictions make sense. A second crucial role in FP&A is the storyteller, who clearly communicates the meaning of the results and the necessary decisions to the business.

Will be responsible for selecting and refining AI models, ensuring data inputs are clean, and interpreting outputs. They will guide AI/ML algorithms to deliver meaningful and accurate insights.

Will play a pivotal role in translating technical findings into compelling narratives. They bridge the gap between data and decision-makers by using their data visualization and communication skills to present strategic insights.

TriLink Biotechnologies, a US-based biotech innovator, enhanced its product managers’ forecasts by implementing machine learning-powered rolling forecasts. By using ML in conjunction with driver-based models through the Board planning platform, product managers were able to rely on automated forecasts instead of manual spreadsheets. This allowed them to focus on strategic analysis rather than data processing, leading to improved data quality and reduced manual effort. The unified platform provided a single source of truth across operations, finance, and sales, which enabled more accurate forecasting and strategic decision-making.

In summary, AI increases FP&A’s value as a business partner by enabling a better understanding of the key business drivers and activating new conversations and insights that were not possible before. Nonetheless, AI is not the master; it is an assistant. While it is good at discovering underlying trends, its results and suggested actions are enhanced and rationalized by human judgment.

Discover more FP&A insight from Michael here:

It’s time to start leveraging AI in financial planning and analysis