Don’t Replace APO – Rethink Supply Chain Planning

SAP Advanced Planner and Optimizer (APO) has been marked for end of life (EOL). For…

Retailers everywhere are asking the same question: If sales are growing, why isn’t profit keeping up?

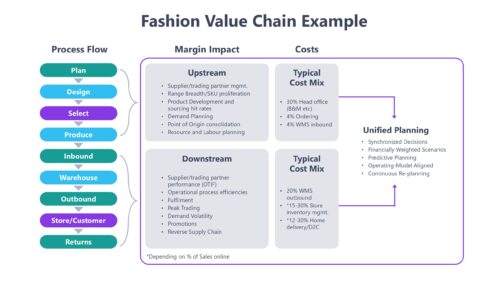

The answer lies not just in pricing or promotions, but in how costs are planned, connected, and controlled across the retail value chain.

Omnichannel has multiplied opportunity — and multiplied cost.

Every customer promise — free returns, rapid delivery, endless assortment — adds hidden layers of labor, logistics, and systems cost that quietly erode margin.

The figure below shows how these costs stack up across the value chain — from upstream sourcing and planning to downstream fulfilment and returns.

Each stage creates friction:

The result? $1.7 trillion in annual inventory distortion across global retail — value lost not to competition, but to disconnected decisions.

Most retailers still plan in layers — finance, merchandising, and supply chain each moving at a different rhythm.

The cost isn’t inefficiency — it’s lost agility.

Unified planning closes the gap, connecting strategic, financial, and operational decisions through one model that mirrors how the business actually runs.

With AI-enabled visibility, planners can:

It’s planning aligned to the operating model — synchronized, financially weighted, predictive, and continuously re-planned.

Retailers have long measured success against a plan written six months ago — not the market they’re selling into today.

That disconnect between pre-season intent and in-season reality is one of the most expensive gaps in retail planning.

Traditional assortment planning locks in product and volume decisions too early. By the time tariffs shift, social trends move, or new lines underperform, the plan has hardened — and margin starts leaking through discounts, over-buys, and missed continuity replenishment.

Retailers need to evolve the merchandise planning to include ‘assortment sensing’ that unites what to sell, where to sell, and when to flow it dynamically across two distinct planning horizons.

Unlike demand sensing, which focuses narrowly on volume, Assortment Sensing links product, channel, and timing — connecting every planning decision across both continuity and new-line products.

Here’s how it works in practice:

The RSR 2025 Merchandising Benchmark found that while only one in three retailers can currently keep pace with customer behavior, nearly all see AI-driven localization and in-season re-planning as essential to protecting margin.

Assortment Sensing bridges that divide. It turns rigid, calendar-based planning into a living system of signals and scenarios — one that listens to the customer, aligns to finance, and delivers confidence in every decision.

AI doesn’t replace the merchant’s art — it amplifies it.

By uniting predictive insights with financial alignment, retailers move from reactive correction to proactive confidence.

Unified, AI-powered planning helps teams:

Every decision becomes measurable, traceable, and confidently owned.

So, where has your margin gone?

It’s scattered across unconnected plans, lagging forecasts, and static assortments that can’t keep pace with real-time retail.

The retailers winning it back aren’t planning harder — they’re planning with confidence.

They’re connecting strategy, finance, merchandising, and supply in one intelligent rhythm that turns every cost into a confident decision.

Because in modern retail, confidence is the new margin.

“In the Age of AI, confidence — not caution — is the true competitive advantage.”

—

See how Board’s Unified Merchandising Planning helps retailers sense, simulate, and re-plan assortments with confidence.

→ Explore Unified Merchandising Planning