3 tendances qui impactent les équipes financières en 2024

Bienvenue au sein d’un département finance d’aujourd’hui, où les tendances sont déjà en train de…

Welcome to today’s Office of Finance—where trends are already reshaping an industry poised for what’s next. In this line of business, staying ahead of the curve is no longer a luxury. It’s quickly becoming table stakes…

So, there’s no time to waste. Let’s dive into 3 trends that are certain to impact your finance team in 2024 (and beyond).

In the fast-paced world of finance, adaptability is key to survival. As we enter 2024, one thing is abundantly clear: artificial intelligence (AI) will be the driving force behind the next wave of automation in Financial Planning and Analysis (FP&A). While automation has been a buzzword for years, AI is set to revolutionize how companies approach financial planning, forecasting, and decision-making processes. Here’s how…

FP&A is skilling up to leverage advanced analytics

Several factors are converging to push companies towards integrating AI into their FP&A processes. In addition to traditional financial acumen, professionals need to be proficient in data analysis and AI-driven technologies. This shift in skill requirements reflects the growing importance of leveraging advanced analytics in FP&A to extract insights from vast amounts of data.

AI is now in everyone’s hands

Advancements in AI tools offer intuitive interfaces and functionalities that empower finance professionals to harness the power of AI without extensive technical expertise. Companies look at innovative ways to remain competitive with narrowing profit margins in certain industries. By navigating business complexity beyond traditional automation, AI is an opportunity to generate more accurate forecasting, efficient resource allocation, and proactive risk management.

Leading the way: Production and inventory management

One area where AI is poised to impact supply chain management significantly is supply chain management. The supply chain function has always been plagued by complexity, but AI-driven tools can streamline operations, enhance productivity, and mitigate risks. By leveraging AI algorithms, finance teams can optimize inventory management, identify cost-saving opportunities, and respond quickly to market fluctuations.

Biobest did it: Predictive demand forecasting

“Our customers place their orders just a couple of days before receiving their goods, so the big question is, how much should we produce? We don’t want to let our customers down, so high availability is key, but too big harvests will create waste and lead us to incur unnecessary costs. We want to avoid this to ensure our products remain affordable. As an environmentally friendly company, we want to protect our resources, too.” ~ Luc Buntinx, Business Application Manager at Biobest.

Biobest found its solution using automated predictive modeling that searches for trends to forecast future demand. Local teams use this to refine their final forecasts. The company shifted to a centralized approach to speed up the aggregation process, combining forecasted demand with production capacity data from sites worldwide to better balance capacity with demand. This process allowed them to have real-time insights into their markets and react faster to sudden increases or decreases in demand.

Finally, generative AI and ad-hoc reporting

With the right setup of data enabled by a platform that can handle large volumes and maintain full depth of granularity, we will also see companies leveraging AI for their day-to-day activities. As new opportunities emerge or conditions change, FP&A teams will more often leverage tools like co-pilots to auto-generate simple reports upon request. This velocity in addressing a need for detailed analysis is already becoming a huge time saver for the finance function.

Looking ahead to 2024, AI is set to become the new frontier of automation in FP&A. By harnessing the power of AI and predictive analytics, finance teams can gain a competitive edge, adapt to market dynamics, and drive business growth.

Over the past few years, FP&A has been through massive changes. The market is tougher, forcing companies to react faster and go deeper into their business to identify drivers that will maintain margins to an acceptable level for long-term prosperity. Here’s how…

Supporting transformation

Companies have started to invest in transformation projects to modernize their tech stack, laying a robust foundation for the upcoming changes. However, the critical question for finance leaders is whether their teams are ready for the shift. Embracing the latest technological changes successfully requires new skills and capabilities. It’s not just about having the tools but enabling teams to use them with agility, flexibility, and at their full potential.

According to 2023 FP&A Trends Maturity Model evidence, FP&A teams have evolved into data storytellers, incorporating real-time data and predictive modeling to go beyond the presentation of historical views to make smarter decisions in the foreseeable future.

Soft skills are in high demand

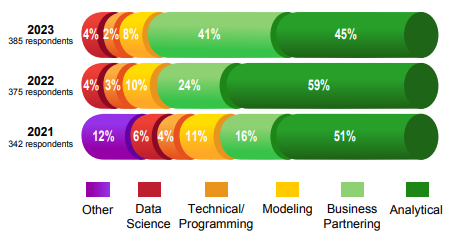

As FP&A incorporates forward-looking data views, it becomes more influential in decision-making across organizations. The trend is noticeable in the hiring process. A survey from FP&A Trends shows that analytical skills remain a top recruitment priority (from 51% in 2021 to 45% in 2023), while business partnering skills are exploding (from 16% to 41%).

Using soft skills such as communication and the ability to explain numbers in “non-financial language,” FP&A will build the link across the organization with its ability to understand other departments and present information in a clear and user-friendly manner.

Critical Skills in FP&A Staff Recruitment

FP&A is going deeper into business

For FP&A teams, aligning with industry standards and company goals involves understanding how the business operates (and being able to react to changes). Beyond knowing the numbers, it’s about articulating financial impacts, understanding cost movements, recognizing emerging trends, and telling compelling stories that resonate with other departments.

These skills facilitate collaboration and contribute to a holistic understanding of the bigger picture.

Heads up! New roles are coming soon

On the hard skills front, FP&A teams are also looking at roles like data architects and data scientists. These professionals bridge the gap between finance and IT, which is essential for managing FP&A tools effectively. With easy-to-use, low-code, no-code platforms, FP&A teams can own their architecture, providing a level of agility that positions companies ahead of the competition.

The evolution of FP&A teams goes beyond technological advancements. It requires a holistic approach, encompassing both soft and hard skills. The future of FP&A lies in the ability to generate meaningful insights, tell compelling stories, and navigate the ever-changing landscape of finance with speed and precision.

In recent years, Environmental, Social, and Governance (ESG) considerations have evolved from producing a glossy report to a central focus for businesses worldwide. What started as a regulatory obligation has become a catalyst for profound organizational change and sustainable transformation. Here’s how…

Regulatory focus shifts to performance management

Initially, ESG compliance revolved around meeting regulatory requirements and ensuring accurate reporting. Initiatives, such as the CSRD in the EU or the NFRD in the UK, have provided clear guidelines for what companies expect to report annually. Given the recent proposal from the SEC, the US is preparing to adopt a similar approach. However, the rush to comply has sparked introspection: is all this just about compliance reporting? How can we integrate ESG principles into our business for long-term sustainability?

ESG as a strategic opportunity

Once companies have published their first regulated report (early 2025 for EU companies), there will be considerably less stress around compliance. The logical next step for experts is to reimagine ESG from a constraint to an opportunity. Environmental objectives can attract talent, reshape pricing models, and enhance short- and long-term profitability.

The role of controlling/integrating with finance

Controlling departments plays a pivotal role in quantifying and auditing ESG activities. Collaborating with FP&A, they facilitate an integrated approach to external reporting. Looking ahead, the integration of ESG into the FP&A function promises to align ESG concerns with strategic decision-making.

ESG meets planning to break down silos

ESG reporting requires data collection from various operational teams, presenting a significant challenge for many companies. FP&A teams, equipped with agile tools, are poised to navigate this complexity. The convergence of managerial and statutory reporting is crucial to avoid last-minute rushes and approximations.

They did it: ESG integrated into planning

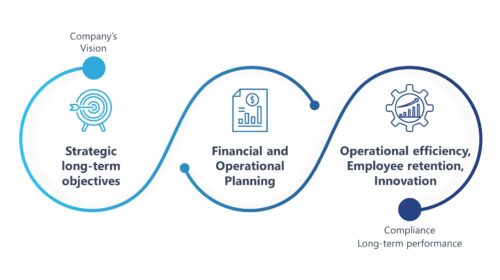

A French retailer recently integrated sustainability KPIs into the corporate strategy to better control long-term performance and maintain sustainable growth.

It started with the company’s long-term objective to reduce their carbon footprint. The difficulty was navigating the structural complexity of the business operating in multiple countries with many stores. With a unified platform, they created a top-to-bottom funnel analysis looking at all sub-sources of CO2. This allowed for a better understanding of emissions and helped trigger an action plan.

The company’s second step was integrating this into its financial planning to design a forward-looking view of the business. They created 2 scenarios: the baseline and the green scenario. Each business line could then define which levers to activate (i.e. improve energy efficiency, increase renewable energy, or focus on increasing business drivers such as sales).

With this operational information flowing into financial planning, decisions could be taken not only by looking at financial drivers but also by looking at ESG impact. Finance teams can now monitor, run analysis and scenarios, and report on the various aspects of the business—from operational activities to carbon emissions to financial impact. And balance decision-making in a wider context.

Embracing ESG as a strategic imperative

As businesses strive to go beyond compliance, the integration of ESG into decision-making processes becomes paramount. This entails evaluating the impact of strategic objectives on the environment, society, and governance. By embracing sustainability as a core principle, companies can build resilience, foster innovation, and ensure long-term success.

ESG is no longer just a box to tick for regulatory purposes. It’s a pathway to sustainable transformation, where businesses operate with purpose, authenticity, and a commitment to creating value for all stakeholders. As we navigate an increasingly complex and interconnected world, embracing ESG isn’t just the right thing to do—it’s the smart thing to do for enduring success.

Want to learn more about these trends and how they impact finance planning in 2024? We have curated a playlist of some useful videos that delve into the topics more.

What are top-performing organizations doing with FP&A (and what lessons can we learn)?