Understanding the key drivers of inventory distortion

When we talk about $690.9 billion in out-of-stock losses globally, we're not describing a simple…

This is the first in a series exploring the IHL Group’s comprehensive Inventory Distortion Study, research that exposes the staggering scale of global retail’s inventory crisis and the path forward.

Picture this: $1.7 trillion in lost value every year from inventory that’s either missing when customers want it or sitting unsold when they don’t, a figure that matches South Korea’s entire GDP. However, it’s not a projection or a hypothetical what-if scenario. This figure comes directly from IHL Group’s recent study and analysis of inventory distortion worldwide, representing the true cost of a retail planning crisis.

What makes this crisis particularly challenging is that inventory distortion has inventory distortion has become as unpredictable as the consumers retailers serve, exposing brittle planning processes still anchored in outdated cycles.

|

The IHL Group found that while inventory distortion as a percentage of retail sales has improved 6.5% in 2025, down historic highs, the absolute scale of the problem continues to grow. Despite mounting tariffs and protectionist pressures, global inventory distortion demonstrates that retailers cannot retreat from the complex, interconnected supply networks that modern commerce demands. Perhaps most significant is the expanding performance chasm separating retailers who have modernized their planning strategies from those stuck with rigid, legacy approaches. |

|

These aren’t just replenishment hiccups. They are the symptoms of planning horizons that are too short, forecasts that lack external signals, and siloed processes that fail to reconcile finance, merchandising, and supply.

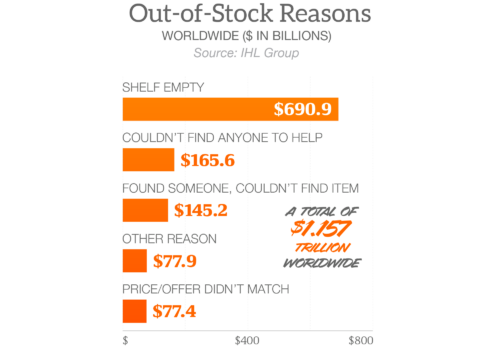

Empty shelves account for $690.1 billion of the total distortion, over 65% of all out-of-stock losses worldwide. Yet, this isn’t only about replenishment failures, IHL Group shows systematic gaps in demand sensing, supplier coordination and the shirt planning horizons that leave retailers always reacting to shortages versus anticipating needs or staying ahead of demand.

When customers can’t find help in stores or associates can’t locate items that show as “available”, we’re seeing the downstream effects of planning processes that haven’t evolved to support today’s complex retail and inventory reality.

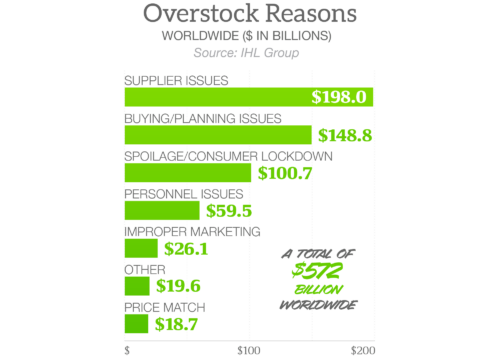

Similarly, the overstock picture reveals supplier issues drive $198 bullion in excess inventory annually, while buying and planning failures contribute to another $149 billion. These aren’t simple operations hiccups. They reflect planning approaches that struggle with volatility, lack real-time visibility and operate in functional siloes.

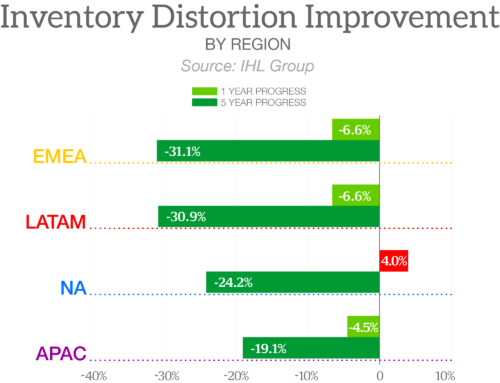

The IHL Study reveals distinct regional patterns that underscore why one-size-fits-all solutions tend to fail.

These regional contrasts underline why retailers need planning frameworks flexible enough to adapt to local conditions, but unified enough to keep finance, merchandising, and supply aligned globally.

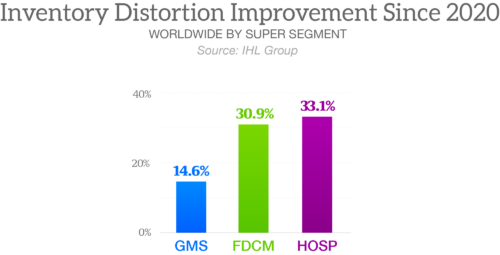

Retail segments face distinctly different inventory challenges:

Perhaps the most striking finding is the disconnect between technology investment and results. Retailers are spending more on digital transformation than ever, yet many continue struggling with fundamental inventory challenges. Are businesses simply patching leaking buckets? Or are they adopting a fully integrated transformation for continuous planning? Point solutions add data, but only integrated planning frameworks close the loop between strategy, finance, and execution.

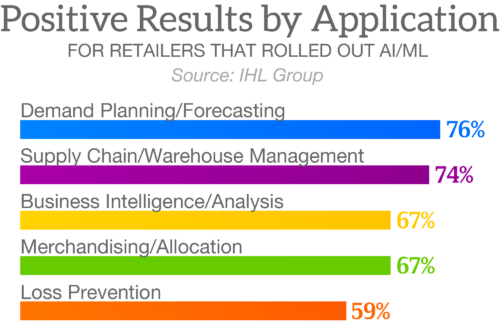

The research reveals why: less than 25% of retailers have successfully rolled out AI/ML in areas most impacted by inventory distortion. Among those who have, the results are dramatic. 76% report positive results in demand planning and forecasting, while retailers using AI/ML expect 50% higher profit growth than competitors.

Technology is part of the solution. But the retailers seeing lasting impact are those embedding these tools inside integrated business planning processes — where finance, merchandising, and supply share one version of the truth.

The study identifies clear characteristics of inventory excellence:

Three forces make addressing inventory distortion more urgent than ever:

The retailers who solve inventory distortion do it by breaking silos. Integrated planning delivers not just fewer losses, but margin protection, working capital release, and confident decisions across the business.

In the coming weeks, we’ll dive deeper into specific findings from this research. The $1.7 trillion inventory distortion problem represents both retail’s biggest operational challenge and its greatest opportunity. For retailers ready to rethink planning, the path to differentiation has never been more clear.

Get the full report: Fixing Inventory Distortion >

Plus, catch up on the next post for this series, a deep dive into Chapter 1, Out-of-stocks versus Overstocks.