What FP&A trends are we expecting to see in 2022?

Evolution is the critical theme of FP&A in 2022. As businesses still learn how to…

In a previous blog, I explained how zero-based budgeting is one of the first steps in transforming the FP&A function and processes. This key tool makes it easier to evaluate current corporate spending and investments, but it also lays the foundation for transitioning from a static budgeting model to a rolling forecast.

The transition from a somewhat static to a highly agile organization is necessary for business success, especially in challenging times. Let’s dig deeper into what it means to have a rolling forecast, as well as what type of technology you need to create accurate forecasts.

A rolling forecast is a financial management tool that continuously updates a company’s financial projections over a defined time horizon. Unlike traditional budgets that are fixed for a fiscal year, a rolling forecast “rolls” forward at regular intervals, typically monthly or quarterly, by adding a new period as the most recent one concludes. It differs from the traditional budgeting process in these ways:

It’s easy to see the appeal of having a rolling forecast. The outlook is adjustable at any time for any horizon (6, 12, 18, 24 months — whatever your organization chooses). For illustration, assume Company A has adopted a rolling forecast that forecasts each month over the next 12 months. One of those forecasts, through no extra effort, is defined as the budget.

This is one of the theoretical selling points of the rolling forecast concept — that another (rolling) forecast replaces the hectic and time-consuming budget process. Let’s say that happens in November. As 2025 unfolds, a revised forecast runs at the end of each month throughout the next 12 months.

The traditional forecasting process only extends to the end of the current fiscal year. Rolling forecasts provide greater visibility into an extended time horizon. If a rolling forecast is accurate, it can help an organization prepare for “what’s around the corner” and mobilize resources more effectively.

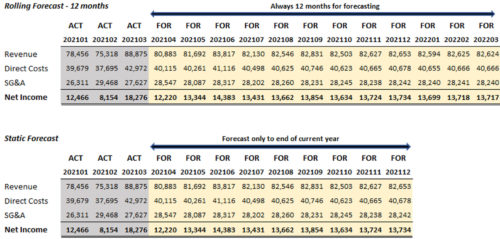

The graphic below illustrates the time horizon flexibility of a rolling forecast versus one limited to the current fiscal year.

You can see how the rolling forecast approach, outlined above, delivers a continuous, evolving 12-month forecast. Put another way, as a company progresses throughout the year, it simply adds another month’s worth of data for forecasting. Compared to a traditional process that restricts forecasts to the current fiscal year and looks at a continually shorter time horizon, rolling forecasts continue to provide visibility into the next 12 months (in this example). If those forecasts are accurate, that additional visibility can drive considerable business value.

A rolling forecast, if designed well, is a powerful management tool that allows organizations to weather the ebbs and flows of potential — perhaps inevitable — market turbulence by allowing faster adjustments given additional foresight. However, building and constantly updating a rolling forecast comes with challenges if the organization lacks the proper automation.

The typical budgeting process is akin to gazing at a crystal ball and trying to guess what will happen in the future. Traditionally, management starts by reviewing the strategic plan for the next 3 to 5 years. The next step is to set targets for the company’s revenue and expenses. In many companies, these targets then go “over the fence” to the tactical and operational teams.

Department managers plan for their expected revenue (if applicable), headcount, CapEx and expenses. Typically, the FP&A team coordinates all this activity and assesses working capital requirements, develops cash forecasts and so on.

This annual exercise uses significant company resources, often at the expense of other vital activities. The result? A finalized budget in December that started back in August. In some companies, this is the only form of budget planning. If that’s the case, there are significant issues:

Some companies augment the traditional planning process with quarterly forecasts, so they’re not necessarily tied to a static budget. That’s a good step forward. However, as previously discussed, this doesn’t provide enough visibility beyond the current fiscal year.

The number one reason companies don’t embrace rolling forecasts is because using traditional spreadsheets makes them nearly unmanageable. Spreadsheets are useful for simple tasks, but they require a tremendous amount of human input. When you have multiple team members working on the same spreadsheet, a simple data-entry error can lead to significant planning problems down the line. If a spreadsheet is large enough, it’s also possible for rows of data to get cut off, leaving your FP&A team struggling to make accurate predictions.

So, what are the requirements for a rolling forecast system?

At a high level, you need a fully integrated platform encompassing financial and operational planning, reporting and analysis to enable straight-through processing. From an administrative perspective, setting up a new forecast should be as simple as checking a box for each month included in the initial forecast (and each relevant month of actual results). The system itself should create the necessary input forms based on your entries.

Additionally, the system needs to be able to automate the process of pulling the data from multiple systems, then staging the data as needed. This eliminates the need for CSV data dumps and manual transformation. The system should also accommodate the use of drivers so that a change in a key driver automatically updates the P&L.

The goal is to make data-driven business decisions quickly and efficiently, improving an organization’s financial, operational and reputational positions.

Some additional considerations include:

Note that this dependence also hinges on factors such as industry type and when returns on investments are expected, balanced with the knowledge that a longer forecasting horizon means less accuracy in future months.

I’ll leave you with this thought. Why focus only on the current year when you can cross over many years, using a rolling forecast that uses the most up-to-date and relevant data? Using an agile planning solution allows you to create flexible forecasts that become part of your company culture and improve business results.

Request a personalized demo to discover how The Enterprise Planning Platform helps you make timely, data-driven decisions.

Learn how one of the world's leading robotics manufacturers is using rolling forecasts to drive growth as part of a fully integrated S&OP process.