Board FP&A FAQs: Straight Answers, Fast

Board FP&A FAQs

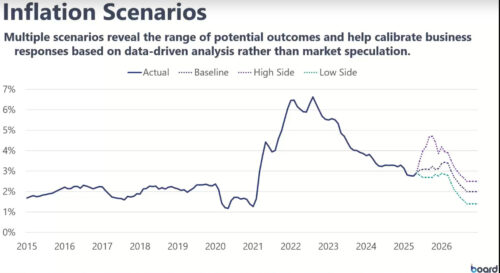

In our recent webinar, Navigating Inflation Through Econometric Scenario Modeling with Board Foresight, with Justin Croft, VP of Data Science & Solution Architecture at Qubit, and Natalie Gallagher, Principal Economist at Board, the topic of scenario planning was front and center.

Across the globe, the current economic environment presents unprecedented challenges for FP&A teams. From volatile trade dynamics to weather to geopolitical unrest, organizations must navigate constant uncertainty while making critical business decisions. There can’t be a pause. Traditional planning approaches that worked in stable environments are failing when black swan events can render annual budgets “outdated and even meaningless overnight.”

The solution isn’t to abandon planning, rather it’s to evolve how we plan. Scenario planning, powered by data-driven insights and modern platforms, have become essential for organizations that want to thrive in uncertainty rather than merely survive.

Uncertainty is the New Normal

Scenario planning has become essential because traditional rigid planning with static annual budgets simply cannot cope with today’s pace of change, where black swan events like COVID or sudden inflation surges can make existing forecasts meaningless overnight. As Natalie Gallagher stated in the webinar, “When you’re in this situation, the only way to be able to do that is to be proactive in your scenario planning” to respond quickly and make good decisions in limited time. Rather than scrambling when unexpected events hit, scenario planning creates a playbook for what-if situations, allowing organizations to have contingency plans ready and execute with confidence instead of freezing up and being reactive.

Natalie emphasized the unique challenges of our current moment, “Right now is absolutely one of those periods. And so we have a really variable commerce environment? Our trade dynamics are changing very rapidly. This creates a lot of uncertainty, especially for businesses that engage in cross-national dealings, have supply chain dependencies.”

|

Variable Commerce Environments Variable Commerce environments create multiple possible inflation pathways. |

|

Isolating Key Drivers Isolating high-level drivers (supply chains, labor markets, monetary policy) enables proactive planning |

|

Tailored Frameworks Business-specific sensitivities require tailored scenario frameworks |

|

Flexibility Over Precision Flexibility beats precision when economic conditions shift frequently |

Being data-driven means grounding your scenario planning in real, quantifiable external data sources like macroeconomic indicators, inflation rates, and industry trends rather than relying on gut feelings about market conditions. It’s about having the ability to identify what your business is most heavily correlated to in an economic context, then using that foundation to cut through conflicting signals and noise to make objective, grounded decisions when volatility strikes.

Natalie highlighted this critical distinction: “When you’re hearing a lot of conflicting information, the best thing you can do as… a business leader is get back to the data and that’s what Board Foresight absolutely allows you to do… We have a platform that has over 5 million data sets that cover 180 countries.” This information can be incorporated into your planning model to support more accuracy forecasting, providing you a competitive edge.

The Flexibility vs. Precision Balance

One of the most valuable insights from the webinar was Natalie’s perspective on flexibility versus precision. “When we are in a quite volatile environment, I would really stress flexibility over precision,” she explained. “When you have a really volatile environment, nobody really knows what tomorrow holds…. So one thing we can say about your baseline is it probably has an assumption that isn’t going be correct…. You’re not going have perfect precision. It’s just a given. So you really need to be flexible.”

This insight challenges the traditional finance mindset that prioritizes accuracy above all else. In volatile environments, the ability to adapt quickly becomes more valuable than attempting to predict with complete accuracy.

Go Beyond Single-Point Forecasts

Like the character Q from a James Bond film, scenario planning is always being ready with all the right gadgets for any situation. Planning ahead and having solutions. Scenario planning in FP&A means building multiple “what-if” models instead of relying on a single forecast. As Justin explained: “Essentially, scenario planning means building multiple what-if models instead of a single forecast. For example, you might have an optimistic scenario, a pessimistic scenario…assuming a recession or supply shock…. Each scenario provides a data-driven narrative about the future.”

The key insight is that “it’s not about predicting the future with 100% accuracy, it’s about being prepared.” Scenario planning gives organizations a way to ask “what if” in advance and have responses ready for whatever comes.

Three Critical Benefits of Scenario Planning

Focus on Key Financial Drivers

Not every line item needs a scenario. Focus on the big levers like market demand, pricing, cost of goods, interest rates, and other assumptions that will vary significantly from scenario to scenario. The goal is to identify the key variables that have the most material impact on your business performance.

Build a Range of Scenarios

While you can have as many scenarios as you want, it’s advisable to always build at least three scenarios: baseline, upside and downside. The idea is to test the boundaries so if things go much better or worse than planned, what are the financial impacts? This range gives you a realistic view of potential outcomes and helps you prepare for multiple futures.

Link Scenarios to Real-World Triggers

Create predefined triggers tied to your planning. For example, decide in advance that if quarterly sales fall below a specific threshold, you switch to your pessimistic scenario and implement predetermined cost-cutting measures. These triggers enable faster decision-making when conditions change.

Implement Participation Across the Organization

As Justin emphasized, scenario planning must have top-level support where C-level championing is critical to take hold. However, you also need input from all key departments as implementing scenario responses like “reducing hiring or adjusting sales targets or rerouting supply chains really requires that cross-functional input.”

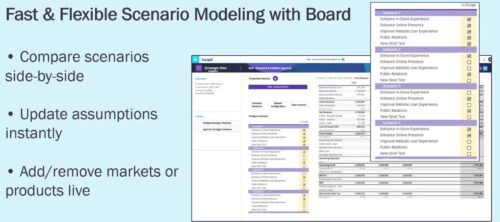

Speed and Flexibility When It Matters Most

One of Board’s biggest strengths is speed and flexibility in simulation. Justin stated, “In the heat of uncertainty, you don’t have weeks to rebuild spreadsheets or tweak models. You need to model changes on demand and Board was built for that.”

An example Justin described with Board, if you’re asked to model a 10% price increase, you can generate a new scenario very quickly and run that analysis. Board updates everything in real time as one assumption change updates all related figures immediately across all dimensions, unlike spreadsheets where changes would require manual consolidation (or inputs) across dozens of sheets.

AI-Powered Planning and Advanced Analytics

Board delivers statistical reliability through AI, helping finance teams create accurate forecasts. Key features include a reverse algorithm for write-back what-if analysis in any direction, the Beam Forecasting Engine integrated for ML- and AI-driven predictions, and no spreadsheet planning mayhem to get faster insights and confidence in data integrity.

Unified Platform with Real-Time External Data

Numbers should be grounded in reality where both internal and latest external factors like macroeconomic trends, market indices, and consumer trends are pulled into models for greater forecast accuracy. Board Signals is essentially an economic data hub built into the platform. Board Foresight aligns your scenarios with the relevant industry- or region-specific external factors to let you see forecast outcomes. You can automatically integrate external economic data like inflation rates, commodity prices, and Federal Reserve projection, enabling data-driven scenario planning that updates in real time in your financial models. This provides you with more credible forecasts and allows you to identify risks and opportunities early.

Many finance leaders understand why scenario planning is critical, but feel overwhelmed by software implementation. As Natalie acknowledged, “I understand why scenario planning is important. I absolutely see the need for it, but it can feel like a little bit of a behemoth to get started? Because whenever we introduce something new to our processes, it’s always the devils in the details. How do I get there?”

Board addresses this challenge by making sophisticated scenario planning accessible to business users, not just data scientists. The platform delivers sophisticated statistical analysis through an intuitive interface that finance professionals can master without requiring coding skills or technical expertise in R, Python, or SAS.

As Natalie noted about Board’s advantage over code-based solutions, “One of the value adds you get is not only having a robust modeling, but it’s also having a software where everybody can clearly see the assumptions, manipulate things quite easily, and then have everything flow through. So it’s really [an] add-on for stakeholder investment.” Imagine one giant interactive whiteboard of collaboration, team members with no technical coding skills have input and can plan with ease.

Turning Uncertainty into Opportunity

Justin summarized it clearly, “Board offers the strategic depth and the technical muscle to do scenario planning right, helping you turn uncertainty from a threat into an opportunity to outmaneuver competitors.”

The confidence that comes from performing scenario planning fast is a superpower for FP&A leaders today. When unexpected events occur, you’re not paralyzed by uncertainty as you’re prepared with data-driven contingency plans. Board supports scenario planning not just for finance teams, but also to operational teams in supply chain, HR/workforce planning, and sales and commercial planning – empowering customers to link planning across their organization to drive alignment on overall corporate objectives.

Uncertainty is inevitable these days. Whether it’s economic swings, geopolitical shifts, or technological disruptions, it’s a given the future will continue to surprise us. The question for finance leaders is, are you prepared for those surprises?

Scenario planning is how you prepare. It’s how you get your organization more agile and resilient. Manual and siloed processes with legacy tools won’t do. Board empowers finance with a unified platform to navigate volatility and support informed decision-making with confidence.

Watch the on-demand webinar here to hear our experts speak about scenario planning. Ready to get on Board for scenario planning? Get in touch with us here.